Investment Summary

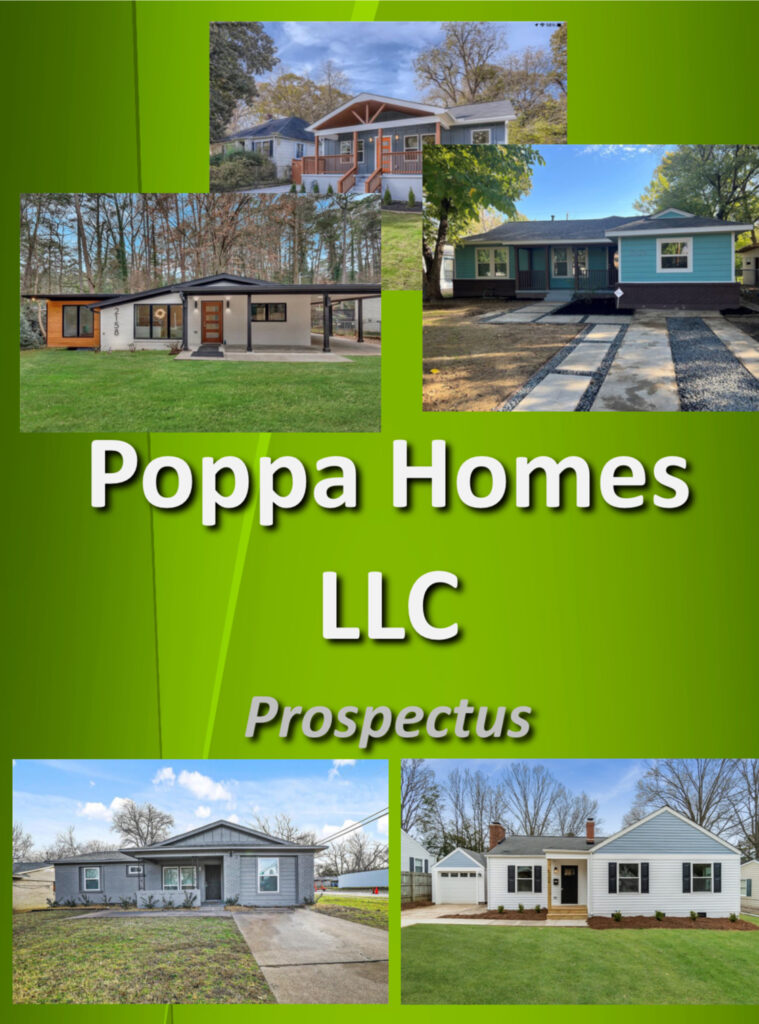

Our company specializes in buying distressed residential properties, completely

renovating the properties, and then re-selling to local homeowners for a profit.

Experience

We have purchased, renovated and resold over 150 properties in 12 different market and

have developed and perfected a system that enables us to consistently find, fix, and flip

residential properties for high profits

Area

A key to its success, our company understands the market and re-sale value of

each property prior to acquisition. Each property is personally inspected and re-

sale values are clearly understood prior to purchase. As such, our company only

invests in specific cities and neighborhoods.

Sales Price

We acquire properties that re-sell from $50,000 to $500,000. We have achieved

great success in the $125,000 to $250,000 sales price range, and also serve the

higher end price range of $250,000 to $500,000.

Turnaround Time

Average turnaround time from acquisition to sale per property is 130-150 days.

Days on Market

Average time on the market is 30 to 60 days.

Contractors

We subcontract all labor and material costs of renovation. Contractors are

licensed and insured.

Net Profit

Average net profit per deal is usually 20% of the after repair sale price

(approximately $30,000 – $50,000 per deal of fix and flip). We use a formula to

determine profit, closing costs, and carrying costs to determine the correct buy

price making the total capital invested 65% of After Repair Value (ARV).

Buy Price Formula:

After Repair Value (ARV)

-profit (20%)

-closing costs (9%)

-carrying costs (6%)

-repairs

=buy price

Renovations

We specialize in high-end remodeled homes. We provide completely renovated,

like “new construction” style remodeled houses. Each features updated electrical,

plumbing, mechanical, roofing and windows, therefore we market to the buyer

looking for a totally modern and updated remodel. This includes new kitchens,

new baths, granite, ceramic tile, and stainless steel appliances, A/C, etc. We

closely follow market trends in order to provide the most modern and desirable

home on the market.

Renovation Management

All renovations are managed daily to ensure quality standards are adhered to and

schedules are consistently met.

Purchasing

We specialize in buying distressed bank owned properties, short sale properties and

privately sold homes at large discounts.

Sales

Once renovations on a home are completed, the property is listed for sale and

marketed on the MLS.

Systems and Procedures

What separates our company from other enterprises is the use of proven systems

for fixing and flipping residential properties. These systems are used to locate

properties, make offers, acquisitions, manage renovations, and sales and

marketing. By utilizing systems, the company easily manages 5-10 projects at a

time.

Safe Investment

We work with numerous private investors and have raised millions of short-term private

money to fund various real estate transactions. Each investor holds a lien position in the

property in which they invest, thus securing the investment with collateral. We give investors

regular progress and financial reports as well as frequently updated pictures.

Private Investors

We work with dozens of private investors and have raised millions of dollars in

short-term private money to fund our fix and flip business.

Private Investor Complete Program

Step1: Once we secure a property under contract to purchase, we present the

money investor with:

• Breakdown of numbers (purchase price, renovation cost, expected sales

price, expected turn-around time)

• Comparable sold comps to justify expected sales price

• As-is before pictures

• Estimated closing date

Step 2: Once private investor agrees to go in on the deal, the following paperwork

is drafted prior to the closing on the purchase:

• Promissory note

• Mortgage

• Personal guarantee

• Business affidavit

• Agreement to change

Once reviewed by both parties and satisfactory, we sign and notarize and originals

are sent to the private investor

Step 3: At time of closing, private investor is given:

• Copy of closing statement

• Wiring instructions

• Insurance certificate

Private investor wires funds directly to Title Company on the day of closing. Title

Company is given copy of executed mortgage and records mortgage (1st lien

position) with county. Once recorded, county sends recorded copy to private

investor.

Private Investor Complete Program (continued)

Step 4: Immediately upon closing of purchase, renovations are started. Once

$10,000 of renovation work is completed and paid for by us, a draw request is

submitted to private investor. Draw requests include:

• Breakdown of money spend

• Pictures of completed work

• Amount of draw requested

Private investor overnights draw check or wire to us

Step 5: Each month we mail interest only payments to private investor based on

pro-rated balance (purchase amount plus draws).

Step 6: Once renovations are complete, buyer is secured, and a closing date set,

private investor provides a payoff letter with principal amount of loan and any

outstanding pro-rated interest. Title company send proceeds directly to private

investor at time of closing and private investor is made whole.

Commonly Asked Questions and Answers

Q: How much is the mortgage amount?

A: The mortgage is for the total capital amount (purchase plus rehab). Even though

the rehab is given in draws, we allow the private investor to lien the entire capital

amount up front. However, interest is only paid on the outstanding balance each

month.

Q: How is my money secured?

A: The mortgage is in the full capital amount invested and is recorded with the

county. This puts a first lien position on the property, which must be paid off when

the property is sold. This means the private investor has collateral for the capital

loaned. In addition, we are so confident in our model to fix and flip properties that

we provide our private investors with a personal guarantee as additional security on

each deal.

Commonly Asked Questions and Answers (continued)

Q: How do I make sure I have a strong equity position on my loan?

A: We only buy property that is at 65% of after repair value less repairs. In other

words, if a property has an after-repair-value (ARV) of $200,000 and needs $40,000

in work, we will buy it for $90,000. Once repairs are made, we will be into the

property for 65% of ARV. This allows us to make a high profit on the deal and gives

our private investors a strong equity position. We provide to the private investor a

list of comps on each deal that justify the ARV.

Q.: How much time do I have to fund a deal?

A: Typically, when we get a deal under contract to purchase, the closing is

scheduled 2-4 weeks later. The private investor must have funds available by

closing.

Q: Do you have any references?

A: We provide references upon request to serious private investors.

Call or Text @ 318-615-9110